Life in San Francisco

Financial Information

Embarking on a U.S. college journey in the vibrant Bay Area comes with its share of expenses. Having sufficient financial resources to support your studies is key to a successful and stress-free experience in the U.S.

Financial Aid

International and exchange students should understand that when studying in the U.S., they are responsible for covering all their expenses. It's important to realize that SF State does not provide financial assistance or cover the expected cost of attendance for international students. In addition, there is no U.S. financial aid or international student scholarships available to cover international students' studies at SF State.

Budget

It's essential to plan and budget accordingly, ensuring you have the necessary funds to cover tuition and fees, health insurance, housing/food/living expenses, books, and school supplies, technology for school, travel/transportation/commuting expenses, and any other expenses while attending SF State.

Expected Expenses v.s. Actual Expenses

Finally, while F-1 and J-1 students may have demonstrated financial readiness for tuition and living costs to receive the I-20 and DS-2019, it's crucial to recognize that unforeseen expenses can arise upon arrival. The true cost of studying at SF State varies for each student. It's essential to be financially prepared to handle these circumstances independently.

Living Expenses in San Francisco

San Francisco has the highest cost of living of any city in the United States. The majority of students' money will go toward educational expenses, food, rent, utilities, and other personal expenses. Students can determine their educational expenses based on the expected costs of tuition and course materials, such as books, access codes, and supplies. The average cost of rent in San Francisco ranges from $2,100 to $6,300, so most students live with roommates to reduce this cost.

Students should take this into consideration before coming to San Francisco and evaluate the amount of funding they will need to live comfortably and safely in the city. When budgeting, prioritize funds for educational purposes, rent, utilities, food, and other essential expenses—plus a small emergency fund, if possible.

Plan a Budget

To maintain financial wellness, begin by creating a budget and do your best to follow it. Additionally:

- Understand your income and expenses: Understanding your expenses and how much income you have available through work, scholarships, family, etc., may sound basic, but it is essential information for planning your budget.

- Create a budget: Write a list of expected expenses and set a limit on how much money you will spend each month on each expense. If your budget is tight, determine the difference between "wants" and "needs." This may sound strict, but knowing exactly how much money you have left over after necessary expenses will help you feel less guilty when spending on things you want, as you'll know you can afford them.

- Follow your budget: Once you have a budget in place, do your best to adhere to it. A budget isn't useful unless you use it!

Here are some helpful resources to assist students with budgeting:

- SF State Abroad - SF Exchange Program Budget - YouTube

- Student Budgeting Tips and College Saving Guide

- 6 Money Mistakes College Students Make

- Campus Financial Literacy Initiatives

Bank Accounts

In addition to general financial planning, students must decide whether to stick with their bank account in their home country or open a temporary one in the U.S. To open a bank account, students should research banks' student account options and contact them regarding their interest.

To learn more about banking in the United States, please visit this resource.

Topics

- Expected expenses while studying at SF State

- Expenses due each semester

- How to plan a budget (Google Sheets)

- Download the worksheet

- Plan ahead! due date timeline for Spring and Fall

- Financial resources

- Next steps

Materials

- Recordings: International Students Financial Literacy (Length: 16:21)

- Presentation slides: International Students Financial Literacy (Google Slides)

- Free budget worksheet: Sample International Student Budget Worksheet (Link to Google Sheets)

(Download as Microsoft Excel or make a copy for yourself)

For international students venturing abroad for education, navigating financial constraints can be a daunting task. Limited financial resources, coupled with the unfamiliarity of a new country's financial landscape, present unique challenges.

We advise all international students to seek and secure financial resources in their home countries before arriving in the U.S. If students wish to seek financial resources in the U.S. after exhausting all financial resources in their home country, below is a list of various financial resources to explore:

The following resources is courtesy of NAFSA: Financial Aid for Undergraduate International Students

Funding Sources: Web Sites with Multiple Scholarship Resources

- Scholarships | San Francisco State Office of Student Financial Aid

- San Francisco State Scholarships

- Scholarship - Study California

- College Board

Free online financial aid source for scholarships, grants, and loans for all college-bound students, including permanent residents and international students wishing to study in the United States. - Scholarship Finder

Searchable database of scholarships, fellowships, grants and other financial aid opportunities. Sponsored by the U.S. Department of Labor. - EducationUSA

Searchable directory of special opportunities and financial aid for international students and scholars. - EduPASS

List of websites that allow international students to search for scholarships. - FastWeb

Free online scholarship search service. - International Education Financial Aid

Free online scholarship search service designed for international students. - International Scholarships

Free online scholarship database for international students wishing to study worldwide. - Mobility International USA

Free online scholarship resource for non–U.S. citizens with disabilities.

Funding Sources: Private Loans

Though rare, there are international student loans available to individuals who meet certain criteria. Many loans require a cosigner. A cosigner is someone who guarantees and is responsible for payment to the loaning institution if for any reason you are unable to pay back the loan. A variety of organizations and institutions provide private loans to international students. Many provide assistance that is targeted to students from specific regions or countries and who meet certain criteria.

When considering taking out a student loan from any private organization or institution, do thorough research and compare the rates and terms offered by various loan providers. Interest rates, repayment terms, loan maximums, and fees can vary significantly between lenders. Carefully review all terms and conditions, and strongly consider seeking advice from a financial advisor or student loan expert to ensure you make an informed decision. These preemptive steps will help secure the best possible loan for your needs.

Interest-Free Loans

The Organization of American States, an international organization based in Washington, DC offers, through the Rowe Fund program, interest-free loans to competent students from Latin American and Caribbean countries to help them finance their graduate, postgraduate, and final two years of undergraduate studies at accredited universities within the United States. For more information and to download the forms, see https://www.oas.org/en/rowefund or e-mail the Rowe Fund Program at rowefund@oas.org.

On-Campus Employment*

*International and Exchange students can not rely on employment to cover their entire expenses during their studies at SF State.

Getting Tax Advice

Students are encouraged to contact the Volunteer Income Tax Assistance Program (VITA) for tax preparation assistance.

Income Tax

All international students, scholars, and their dependents present in the U.S. during any part of the previous calendar year must file annual tax forms between January 1 and April 15 with the Internal Revenue Service (IRS). This rule applies even to those who did not work or earn income in the U.S. during the previous year.

Tax forms are available at most banks and post offices and can be downloaded from the U.S. Government Services and Information website. Detailed instructions accompany these forms.

Because of the complexity of income tax laws, it is advisable to have tax questions answered by the IRS or by a reliable tax consultant.

The Division of International Education cannot offer tax advice.

Why File a Tax Return?

Students authorized to work for pay during their studies at SF State will typically be required by their employer to complete Tax Withholding paperwork.* The employer uses this paperwork to determine how much money in taxes should be withheld from the student’s paychecks or other taxable income, such as stipend payments. Filing a tax return allows the U.S. government to determine whether the employee paid too much or too little in taxes. Employees who paid too much in taxes will receive a refund, while employees who paid too little will be required to pay a specified amount to the U.S. government.

*Students should tell their employer their immigration status (F-1, J-1, H-1B, permanent resident, etc.) for taxation purposes.

No Income Tax Filing - Form 8843

If students are International students in F-1 student visa status and have no income, they must file Form 8843 “Statement for Exempt Individuals and Individuals With a Medical Condition". Social security numbers are not required to file Form 8843. Form 8843 is not an income tax return. It is merely an informational statement required by the U.S. government for international students (including the spouses or dependents of nonresident aliens).

Income Tax Filing - Get Assistance from VITA

Staff at the Division of International Education is neither qualified nor permitted to give individual tax advice. Students with complicated tax situations may wish to consult with a tax preparation service, professional tax accountant, or tax attorney who is knowledgeable about nonresident tax law.

The Volunteer Income Tax Assistance Program (VITA) at San Francisco State University provides free tax return preparation assistance. SF State’s VITA program is sponsored by the IRS and the University’s Beta Alpha Psi - Beta Chi Chapter, an international honor society for business majors.

Other Tax Resources

- Free Tax Bay Area: https://uwba.org/freetaxhelp/

- State of California: https://www.ftb.ca.gov/help/free-tax-help/VITA_Locator/

- IRS: https://irs.treasury.gov/freetaxprep/

Living in the City

Finding a safe, secure housing is a crucial step to preparing for a successful experience at SF State. The average rent in San Francisco is currently $2000 or more per month for a studio apartments, and $3000 or more for one-bedroom apartments.

See current San Francisco rent research at Average Rent in San Francisco, CA and Cost Information - Zumper.

Though San Francisco's rental prices are high, there are still lower-budget options available to students. Students are advised to read the following information below before starting their housing search.

On-Campus Housing

Apply for on-campus housing for Spring 2025 at https://housing.sfsu.edu/apply as soon as possible and secure your spot in a vibrant and supportive living community. SF State University Housing is excited to offer guaranteed housing for all international first-time freshmen, ensuring you have a comfortable and convenient place to call home while you focus on your studies. Transfer students and graduate students are also encouraged to apply!

While assignments are based on availability, we are pleased to announce that housing options are available. Don't miss out on the chance to live in the heart of campus.

You do not need to wait until you are admitted to apply for on-campus housing. Once students receive an SF State student ID and password, they are eligible to complete the online housing application.

Off-Campus Housing

If students wish to live off-campus, they may find Off-Campus Housing resources to be useful. New students can also find SF State-specific Facebook groups where they can post and respond to messages regarding housing and connect with other SF State students who are looking for roommates.

Houses and apartments in San Francisco come in various architectural styles (Victorian, modern, etc.) and sizes (studios, 1-bedroom, 2-bedroom, etc.) and may come unfurnished or furnished. There are many off-campus living options common in San Francisco:

- Sharing an apartment or house with roommates of their choice

- Renting an apartment by themselves

- Renting a room from tenants in an established household with shared common areas (“sublet”)

- Renting a room with an American family (“homestay”)

Temporary Housing after Arriving in San Francisco

It is often easier for students to find long-term housing in San Francisco after they have arrived in the city. For this reason, the Division of International Education recommends that students arrange temporary housing before arriving in San Francisco and then look for more permanent housing after they have arrived in San Francisco. This ensures that they have somewhere to stay upon arrival while looking for long-term accommodations.

The Division of International Education is not able to assist students in finding temporary or long-term housing. If you do not have a friend or relative in the area to stay with, booking a hostel or hotel in advance is the best option.

Please note that it can take one to three weeks to find permanent off-campus housing, so it is best to arrange temporary housing that meets that timeline.

It is not a good idea to try to find permanent housing immediately after getting off a plane, with your luggage, and no knowledge of the city.

House Hunting Tips

Know the Neighborhood

The best way to determine where to live is to spend some time there. Get a meal, go to a café, and walk or bike around to get a sense of what a neighborhood is like before committing to live there.

See San Francisco Neighborhood Guide for more information.

Don’t Rush

Although we understand what a stressful time the first few weeks in San Francisco can be between orientation, the beginning of the semester, and house hunting, don’t feel compelled to take the very first apartment you see. When possible, it is better to take more time to find a living situation knowing it will be comfortable. Taking time will help to get a better sense of which neighborhoods potentially to live in, and after visiting a few different places, it will allow you to get a better idea of standard prices for different types of accommodation in the Bay Area.

Get it in Writing

In order to be protected from scams and less-than-honest landlords/master tenants, it is a good idea to document all the details of the living situation as soon as an agreement is reached. For example, if the landlord or new roommate (master tenant) quotes a monthly rent which includes the cost for water and utilities, have them write up a contract stating the conditions of the lease for each resident before moving in. Keep a copy of this contract in case a dispute occurs.

Beware of Scams

See the Recognizing Scams and Fraud Section below for more information.

Be Cautious

If a landlord or potential housemate/roommate seems untrustworthy, asks for bizarre documents that you would be uncomfortable providing, or gives you a general bad feeling, do not rent that apartment or room.

Typically, your instincts in those situations are correct.

Like many big cities, San Francisco has landlords that may not be reliable. Although there are plenty of rights and protections that you have as a tenant, we do not want students to have an unpleasant living experience or tense relations with roommates or landlords while being here.

Find support with the San Francisco Tenants' Union

The San Francisco Tenants' Union is a community organization that exists as a resource for tenants to help them learn about their rights concerning housing issues such as security deposits, evictions, landlord harassment, roommates, repairs, rent increases, etc. It is important to know your rights in order to be protected if necessary.

Advice from current International Students

- "Get to San Francisco a week before orientation to start looking for housing because looking during orientation week can be stressful."

- "Find a cheap hostel to stay in for a while if no housing is found."

- "Find a house in a well-connected area (in terms of public transportation)."

- "Make sure to find comfortable housing to feel at home—that is important! I was terribly homesick until I moved; now, I don’t want to leave!"

- "Start looking for a home before getting to San Francisco."

- "Look for housing early, and do not despair if it does not go well in a week; every day brings better opportunities."

- "Live with roommates, not alone."

Download this "Help! I Need Medical Care" handout. Also visit the "Seek Medical Help" section in Health Insurance Requirement & U.S. Health Care.

San Francisco Municipal Transportation Agency (SFMTA)

SFMTA is a department of the City and County of San Francisco responsible for the management of all ground transportation in the city. The SFMTA has oversight over the Municipal Railway (Muni) public transit system, which includes buses, light rail, and cable cars.

San Francisco Bay Area Rapid Transit (BART)

BART is a heavy-rail public transit system that connects the San Francisco Peninsula with communities in the East Bay and South Bay. BART operates in five counties (San Francisco, San Mateo, Alameda, Contra Costa, and Santa Clara) with services extending as far as Millbrae, Richmond, Antioch, Dublin/Pleasanton, and Berryessa/North San José.

Clipper Card

The Clipper Card is a public transit card that may be used to access MUNI and BART services. The SF State student ID may be used as a Clipper Card. Please see the OneCard / Gator Pass section for further details.

OneCard / Gator Pass

The OneCard / Gator Pass functions as a student identification card at SF State. Students may use the OneCard to access the following services:

- Clipper Card (see below for details)

- Photo ID card

- Library card

- Print/Copy card

- Declining Balance card

- Access card

- Meal Plan card

The OneCard / Gator Pass also functions as a Clipper Card, providing all-in-one public transit access for the Bay Area. Once students have activated the Clipper Card function on their OneCard, they may access the SF State student benefit for MUNI (unlimited rides, excluding cable cars) and a 50% discount on BART rides to and from the Daly City BART station. Students may also load ClipperCard funds onto their OneCard for general public transit use in the Bay Area.

Please note that the transit benefit and OneCard functions will become active on the first day of the Fall and Spring semester for all enrolled students. Student transit discount will be valid until the last day of the final exams, is valid only for enrolled students who have paid tuition and fees as required, and will not be active over the summer term or during the January intersession term.

While international driver’s licenses are not accepted in California, both F-1 and J-1 visa holders are eligible to apply for a U.S. driver’s license. Tourists may drive in California with licenses from their home countries, but F-1 and J-1 visa holders are not considered tourists (nor are their dependents).

Please note that driving without a valid driver’s license is a serious offense, and penalties may include arrest or impounding of the car at the student’s expense. Those planning to purchase a motor vehicle (e.g. a car, motorized scooter, or motorcycle) must purchase vehicle insurance in addition to obtaining a valid driver’s license.

“Active” F-1 or J-1 Status

In order to obtain a California driver’s license, international students and scholars must be in active F-1 or J-1 status.

F-1 International Students

F-1 International students must have resided in the United States for at least 10 days after initial arrival and have a SEVIS record in “active” status in order to apply for a driver’s license. F-1 visa holders applying for a driver’s license prior to the start of classes or during the first two weeks of the semester should email f1@sfsu.edu to check that they are in active status.

J-1 Exchange Students

For J-1 Exchange students, validation of “active” status may take up to 30 days after initial arrival. J-1 visa holders applying for a driver’s license fewer than 30 days after initial arrival should email exchange@sfsu.edu to check that they are in active status.

Additionally, both F-1 international students and J-1 exchange students must be enrolled full-time unless on Optional Practical Training (OPT) or Academic Training.

Applying for a Driver's License

When applying for a driver’s license, it is best to make an appointment beforehand. Students can schedule an appointment at the nearest Department of Motor Vehicles (DMV) office. During the appointment, students should be prepared to provide required documents, fill out forms, have their photo taken, and complete a vision test.

During the appointment, applicants must pass both a written and a practical driving exam (students must provide their own car for the practical driving exam; this car must be properly registered and insured). It is recommended that students study before taking the written exam, as they will need to know a great deal of information about California and U.S. driving laws. Students can study using the California Driver Handbook. Additionally, the California DMV offers free practice tests.

If approved, the applicant will receive a temporary driver’s license. An official license will be mailed to the applicant’s residential address. Please visit the California Department of Motor Vehicles (DMV) website for additional information.

Please note that the documents required for obtaining a driver’s license are slightly different depending on the applicant’s visa type.

Required Documents for F-1 students

- A valid passport

- Their I-94 document (this document verifies their arrival in the United States; download it here)

- Their Form I-20

- At least two pieces of U.S. residency verification, such as mail addressed to them and received at their physical U.S. address

Required Documents for J-1 students

- A valid passport

- Their I-94 document (this document verifies their arrival in the United States; download it here)

- Their Form DS-2019

- At least two pieces of U.S. residency verification, such as mail addressed to them and received at their physical U.S. address

- Their Social Security Number or Social Security Denial Letter*

Unless approved for paid work, J-1 visa holders are not eligible to apply for a Social Security Number. Instead, they must obtain a Social Security Denial Letter from a Social Security Administration office.

California Identity Card

If students are not planning to drive but would like an official California Identity Card, the Department of Motor Vehicle (DMV) also issues this card, which shows their photo and date of birth information. This is an easily recognizable form of identification that can be used for cashing checks, proving their age, etc. For more information, please visit the DMV’s ID Card webpage.

What is “Scam” and “Fraud”?

“Scam” and “Fraud” refer to when someone uses deceptive or dishonest tactics to steal another person’s money, property, or information.

Below examples are some common scam calls/emails that international students receive. Unfortunately, some scams and fraud specifically target international students. Students should use the information below to protect themselves, friends, and family from falling victim to common scams and fraud.

Immigration Scams

Scammers, often pretending to be from the federal government, sometimes lie by telling the student they are federal agents and then use scare tactics to trick international students into paying them money.

For more information, see Scammers go after international students’ money on the U.S. Federal Trade Commissions (FTC)' website. According to the FTC, once the scammer has obtained the international student’s phone number, they will do the following:

"The caller typically knows about a student’s immigration status and the program or school they’re attending. He’ll say there’s a problem with the student’s immigration documents or visa renewal. And then he’ll demand immediate payment, often thousands of dollars, for a fee or bogus immigration bond. These callers have made threats, including arrest or deportation if the students don’t pay, and they ask to be paid with gift cards (like Google Play or iTunes) or a cryptocurrency (like Bitcoin)"

Remember, the federal government will never call a student and ask them to pay for "fines" over the phone and/or through gift cards (Amazon, iTunes, Google Play, etc.) of any sort.

The scammer might even speak in a student’s native language to make it sound more convincing. Contact the F-1 International Student Advisors at the Division of International Education if they are told there is a problem with their F-1 status. The F-1 advisors are responsible for monitoring their F-1 status and have full access to their SEVIS record and I-20. If we are to call students for their F-1 status issues, we will always state our full name and job title at the beginning of the phone call.

AR-11 scam

Several students receive emails with the subject "Failure to update AR-11 (Alien's change of address card) with USCIS."

The email appeared to be on USCIS letterhead, referenced a case number, and threatened the punishment of fine, imprisonment, or removal from the U.S. It indicates that forwarding the email is a crime and asks the recipient to call a 1-877 number. This is a scam.

Do not respond to this email. Contact f1@sfsu.edu or exchange@sfsu.edu so we can advise you on the next steps.

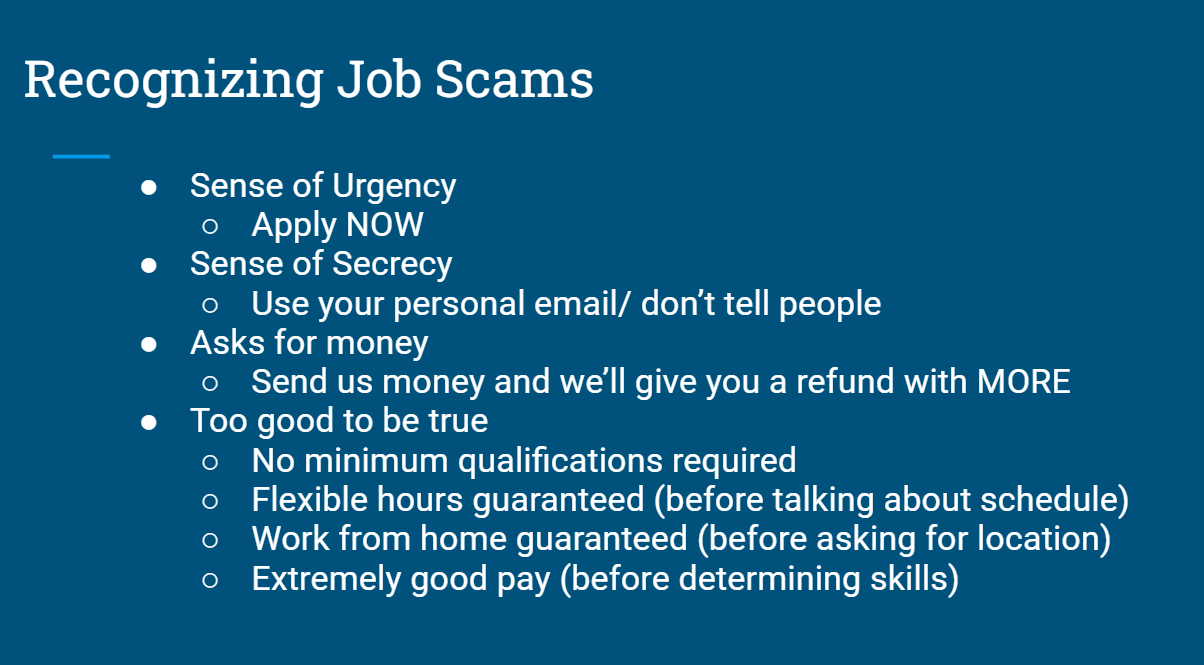

Job Scams

When seeking available jobs, students should be careful of job scams. Job scams tend to have a sense of urgency, telling students to "Apply now or lose out forever!" this is to make sure people don’t take time to think about the job.

There may also be a sense of secrecy, like asking students to use their personal email, don’t tell anyone, or they claim to work for XYZ company but is emailing students with a Gmail account (if they work for XYZ company, they should have an XYZ company email address).

The scammer may ask students for money to “cover” costs up front and they will pay students back with MORE money for their trouble. It’s too good to be true, like no interviews, no minimum qualifications, flexible hours without discussion of what the schedule is, flexible work location before discussion of company policy, and extremely good pay before determining skills. They pretty much are “anything you want, you got it” type of jobs.

There is more information on the Career & Leadership Development website on avoiding job scams and what to do if students accidentally fall for a scam: Avoid Job Scams | Career & Leadership Development (sfsu.edu)

How to recognize job scams

Watch the Recognizing job scams recording (Link to YouTube. Length: 4 minutes).

In this video, we discussed what job scam emails look like and what students need to do if they fall for a job scam.

Internal Revenue Service (IRS) Scams

Students may receive phone calls from individuals, claiming to be representatives of the Internal Revenue Service (IRS). These fake representatives may threaten international students for unpaid taxes and may even tell the student that they will receive jail time if they don’t do what the scammer says. Often, they will ask for the student’s social security number over the phone. A real IRS employee would never do this.

NEVER give anyone Social Security Number information in full over the phone. Also, no one ever pays taxes over the phone or through gift cards.

Apartment Rental / Housing Scams

Another common way that scammers attempt to trick international students is through housing scams. Before moving to the United States, international students often search for housing while abroad. Searching for long-term housing before arriving in San Francisco can be risky. For example, scammers may post fake apartment photos online and ask students to make deposit payments before they arrive in the United States or sign a rental contract. A few things to remember:

- Students should never pay a security deposit, fee, or first month’s rent before they’ve signed a rental contract.

- Don’t rent an apartment that is unavailable to see in-person before signing the contract.

- Do not provide a photocopy of a passport to the "landlord".

Further reading:

- How to spot a Craigslist housing scam (medium.com)

- Most Common Rental Scams and How to Avoid Them (zumper.com)

Suspicious Phone Calls

If students receive phone calls like the ones mentioned above that ask to provide money, do not respond. Stop talking to the person on the phone, and hang up immediately. Here are some additional tips:

- Do not provide any personal information. Additionally, if the scammer who called the student asks them to confirm personal information such as their full name, birth date, social security number, etc., do not confirm the information.

- Speak to someone trustworthy about the call. If students think they may have received a suspicious call, contact the F-1 International Student Advisors, even if the call is not related to F-1 status. Oftentimes, international students realize a call was a scam only after talking with someone else about it. Discussing such situations openly is also a good way to prevent others from falling victim to scammers.

- If students are convinced the call is real, make sure to ask for the caller's full name, title, and agency, and call back number so they can either follow-up if the case is legitimate or report the scam to the police.

Phishing Emails

Phishing is a type of online scam where scammers send an email that appears to be from SF State or a legitimate company. Oftentimes, a phishing email will ask to click an external link or provide sensitive personal information. For more information about phishing emails, read SF State’s Information Technology Services (ITS)’s Phishing Guide and learn how to protect personal email and password information.

Other Helpful Tips

The resources below contain helpful information about the increasing prevalence of scam calls and emails. Read through this information and share it with friends:

Other Useful Information

Social Security numbers are assigned to people who are authorized to work in the U.S. Social Security numbers are used to report worker’s wages to the government and to determine eligibility for Social Security benefits. Social Security Administration will not assign a number to F-1 international students and J-1 exchange students just to enroll in a college or school. Students must obtain U.S. work authorization BEFORE applying for SSN.

An SSN is not a U.S. work authorization. Students should not assume they can work in the U.S. just because they have SSNs.

California State Law vs. Federal Law

As of January 1, 2018, California State law (Proposition 64) allows the legal sale of marijuana to people 21 years old and over. This State law decriminalizes marijuana in California. However, Federal law still prohibits the use or possession of marijuana in the US. Federal laws are established at the national level, and Federal laws override State laws.

International students are subject to FEDERAL law. This means that international students may NOT purchase, use, or possess marijuana, even in states where marijuana use is legal.

Possible Immigration Consequences

When international students enter the United States, their social media accounts, texts, and email are all subject to search. Evidence of marijuana use (such as photos or texts to friends about buying or using) can be reason enough for agents to refuse them entry. International students should therefore use caution when joking about drug use or illegal activity on their social media accounts, texts, or phone.

Again, California State law does not supersede Federal policy. Your American friends might not know that you are subject to Federal law and encourage you to use marijuana. However, you are responsible for understanding U.S. laws as they apply to international students. Do not use marijuana in the U.S.

Alcohol

In the United States, the legal drinking age for buying and consuming alcoholic beverages is 21.

In the United States, the legal drinking age for buying and consuming alcoholic beverages is 21. These rules are strictly enforced, and students 21 and over should be prepared to show an accepted form of photo ID (e.g. passport, driver's license, California state ID) when purchasing alcohol or entering businesses that require customers to be 21 or older.

It is also a crime to purchase alcohol with the intent of giving or selling it to persons under the age of 21.

The information below is designed to provide students with some suggestions on how they can assist their family member(s) in preparing for a B-2 Visitor’s visa at a U.S. consulate or embassy in their home countries. If students are full-time F-1 students and plan to bring their spouse or child to stay with them in the U.S., see F-2 Dependents for instruction.

How to Apply for a U.S. Visitor Visa in a Student’s Home Country

Visit the local U.S. consulate or embassy's website and follow visa application instructions. The student’s family member(s) may need to submit proof of their current status in the U.S. as part of their supporting documents - the proof of their status includes photocopies of their I-20/DS-2019, passport, and I-94 arrival record verifying they have entered the U.S. in F-1 or J-1 status. Students can also provide an Enrollment Verification Letter to prove that they are indeed a full-time registered student at SF State.

Invitation Letter and Template

Providing family member(s) with invitation letters may improve their chances of obtaining visa(s). However, there is no guarantee a visa will be issued. The success of the applicant's request for a visa lies in their ability to prove that they will return to their home countries after the visit.

The invitation letter should be written by the person who is inviting them to the U.S., and that person should be the student. Their invitation letter should include the purpose of their family members' visit, the relationship between them and their family member(s), a brief statement of their current status in the U.S., and their family members' planned period of stay. Download an invitation letter template (Microsoft Word, 12KB) here.

The Division of International Education) does not produce letters of invitation to invite students’ family members to visit the U.S. as the invitation letters from the university are not required by the U.S. Consular Offices for family members to obtain visitor visas.

See Template_Family_Invitation (Microsoft Word, 14KB).

Enrollment Verification Letter

Students can print the Enrollment Verification Letter at their online Student Center.

Invitation Letter for Commencement

If students have applied for graduation and paid the $100 application fee online, they can request a Graduation verification letter. The Graduation verification letter verifies their expected graduation date and the Commencement date. The letter also indicates that all family members are invited to the commencement ceremony.

To obtain the letter:

- Undergraduate students should send a request to SF State Registrar's Office at regweb@sfsu.edu

- Graduate students should contact the Division of Graduate Studies at gradstudies@sfsu.edu.

Other Helpful Tips

Expenses in the U.S.

If the student's family members will be paying his or her own expenses in the United States, documents showing that sufficient funds are currently available must be prepared to be presented to the interviewing officer.

No "immigration intent"

Similar to when applying for a student visa, visiting family member(s) should be able to demonstrate strong family ties to their home countries and be able to show that they will return to their home countries after visiting the U.S. Examples of strong ties include documents that connect a person with their residency status, such as owning a home or having employment, a business, income, family, and/or education in their country of residence.

Dependents of F-1 students include spouses and children, and dependents are allowed to stay in the U.S. in F-2 status for the duration of the F-1 student's study, including any post-completion OPT time. Your dependent(s) must request dependent(s)' I-20s from the Division of International Education to apply for F-2 visas in their home countries or file a change of status to F-2 if they are in the U.S.

It is possible for a J-2 visa holder’s spouse and/or children (21 and under) to accompany them during their program in the United States by entering the country in J-2 dependent status. J-2 dependents may legally remain in the United States as long as the primary (J-1) visa holder maintains legal J-1 status.

Quick Links

Current Students

New Students

Other Resources

Last updated: December 2024

For PDF files, Adobe Acrobat 5.0 or above is required to view it. Adobe Acrobat Reader it's available free from Adobe (link is external).